Category: Innovation, Organisation

Aug 5

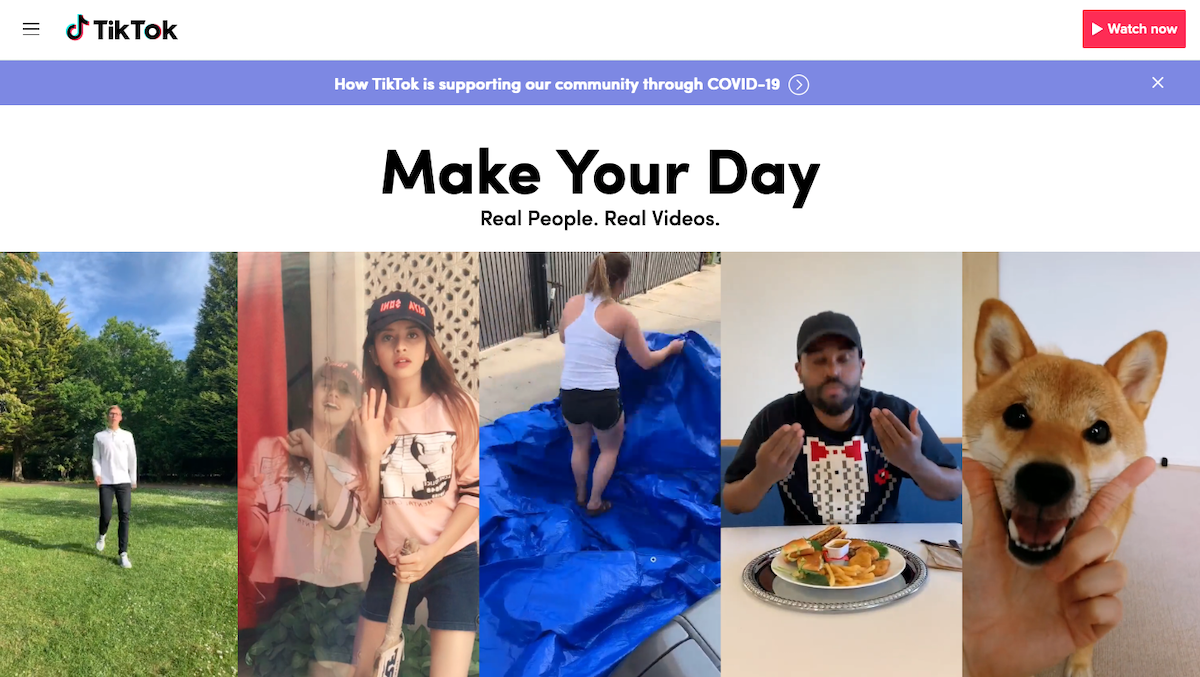

Instead of TikTok We Acquire Monsanto

It is sometimes only a short way from the shooting star to the loathed spy tool to the takeover target. The Chinese music and short video platform TikTok has experienced a steep rise in the last few years and especially since the COVID lockdown. The app has seen two billion downloads so far, of which 315 million alone took place in the first three months of 2020. Four to fifteen-year-olds spend 80 minutes a day on the app, only five minutes behind YouTube. There are 119 million users in India and 165 million in the USA.

ByteDance, the company behind the immensely popular app, currently has $6 billion in cash in its bank account and would actually have no rush to take TikTok public or sell it off. The value of TikTok is estimated at 150 to 180 billion dollars.

Yes, if it hadn’t been for the rapid increase in popularity, there would have been some headwind. So it turned out that the TikTok app is, to say the least, a bit generous with the interpretation of data protection and can have access to email addresses or even the cache, in addition to the usual data such as IP address or gel location. The critics were also given ammunition for some security holes, and ByteDance’s rigorous interpretation of the Chinese government’s demands for content censorship. For example, critical content on the suppression of minorities in China or references to the Tian’anmen massacre are removed or hidden.

After the ban of the app in India and the threat of a ban by the American government, fire is on the roof at ByteDance. Several buyers are said to have been interested in the app, with Microsoft right at the top. This is to prevent a ban and seems to be the intention of US President Trump.

Where is Europe?

While this has led to an outcry in China and is seen as blackmail to sell a successful Chinese company, this itself leads us to a completely different question: namely, why is there no European buyer among those mentioned?

I am well aware that a purchase price of more than a three-digit billion euro amount is not just lying around. For example, SAP, Germany’s most valuable company, is worth almost as much as TikTok. But the question also tends to be, why are our companies so uninterested in buying promising companies? This starts with Instagram and WhatsApp, which were bought for billions of dollars from Facebook, the self-driving start-up Zoox, which was acquired by Amazon, and a number of AI and robotics companies that have taken over the world’s Google, Apple, Microsoft, Amazon, and Facebook.

It may well be true that our companies have not been idle either. For example, SAP bought BusinessObjects, Sybase Concur, and Qualtrics for billions of dollars. VW invested $2.5 billion in the Argo self-driving start-up, and Siemens has now announced a takeover bid from the medical technology company Varian for 14 billion euros. However, when viewed closely, these acquisitions are positioned relatively close to the company’s own business model and existing technology, which should cement existing business models and increase market penetration.

The German weekly Der Spiegel with the Siemens example also points this out. Varian is established as a manufacturer of devices such as computer tomographs and magnetic resonance imaging systems that treat patients who are already ill. Other companies are leading the way in new technologies such as molecular diagnostics, which detect diseases before they break out. However, they do not seem to be interested in these. As quoted from Der Spiegel:

If it remains the case that medicine usually only comes into play when a person is already ill and is intended to support their recovery or prevent their premature death, the 14 billion euros for Varian are probably well invested.

If, on the other hand, the industry is increasingly turning into a prevention company that uses blood or genetic analyses to identify risk groups at an early stage and thus prevent diseases from developing in the first place, Montag and his colleagues might one day regret their decision.

Monsanto

Bayer has to accept the price for what is probably the most blatant example of a bad purchase. Anyone there who thought that the takeover of the American company Monsanto, which is highly controversial because of its genetically modified seeds, was a good idea in 2018, has probably rethought all his life decisions so far. Bayer was immediately confronted with lawsuits costing billions of dollars and the associated write-offs of billions since then. In the second quarter of 2020 alone, the company had to report a loss of EUR 9.5 billion.

When Europeans buy something, it is apparently old-fashioned. But that can not only fail, as in the case of Bayer, but – much more importantly – be too little to secure the future and the continued existence of the company. Above all, tried and tested things do not bring new and fresh thinking into the company.

This article was also published in German.

Recent Comments